- MINT VS YNAB BUDGETING 2019 FOR FREE

- MINT VS YNAB BUDGETING 2019 VERIFICATION

- MINT VS YNAB BUDGETING 2019 TRIAL

- MINT VS YNAB BUDGETING 2019 FREE

Mint also allows you to keep track of all of your monthly payments and receive reminders so that you can pay them on time.

MINT VS YNAB BUDGETING 2019 FREE

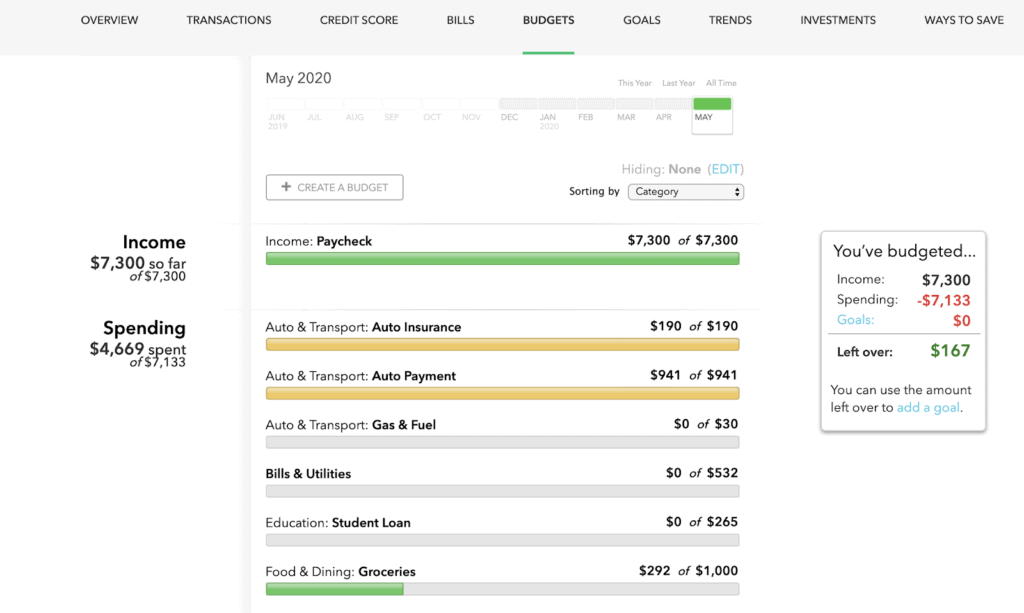

Users are free to link their bank accounts, money management accounts, retirement and investment accounts, credit cards, and other financial accounts with Mint. Users may also use the app to keep track of their spending and savings and establish and monitor budget objectives. Mint is a free budgeting tool that connects all your financial accounts in one digital area, giving you a high-level snapshot of your financial health.

MINT VS YNAB BUDGETING 2019 TRIAL

Signing up for the free trial does not need a credit card.

MINT VS YNAB BUDGETING 2019 FOR FREE

You may also try YNAB for free for 34 days to determine whether it’s a suitable fit for your budgeting requirements.

If you aren’t pleased with YNAB, you can get your money back. Users may join up for a monthly membership for $11.99 per month or a yearly subscription for $84 per year. YNAB is a subscription app, and it’s one of the most expensive to use. The product offers may be obtrusive to specific users, and there is no paid alternative to eliminate the advertisements. Mint makes money through brilliant relationships with other businesses, so the app includes advertisements and offers for other financial services.

You can easily enjoy all of the app’s features and benefits by creating a free account.

MINT VS YNAB BUDGETING 2019 VERIFICATION

To get the most out of Mint, you need to connect all of your accounts, including checking and savings accounts, credit cards, mortgages, loans, investments, and so on. Mint is based on the idea that in order to understand your financial situation, you need to see everything in one location. It’s been operating since 2006, the company behind TurboTax, owns it. What Do They Offer? Mintįor most people, Mint is the go-to personal finance app. We thoroughly investigated the features, simplicity of setup and usage, compatibility, cost, and more to put out a head-to-head comparison of these two popular tools to make it easier for you to determine which platform is ideal for your needs. Those who just want to keep track of their spending and receive a real-time picture of their overall net worth in one location, on the other hand, may prefer Mint’s more basic approach. YNAB gives not only an app, but a whole new way of thinking about what you can do with each dollar you make to anybody who is determined to create a powerful new plan to help them reach financial objectives such as getting out of debt, spending less, or just saving more. However, as you’ll see, these two apps have significant variations, including completely different budgeting philosophies and price methods. Mint and YNAB, which stands for You Need A Budget, are two of the most popular budgeting programs on the market.īoth assist customers in keeping track of all their costs, categorizing, determining how much goes where and making future allocations.

0 kommentar(er)

0 kommentar(er)